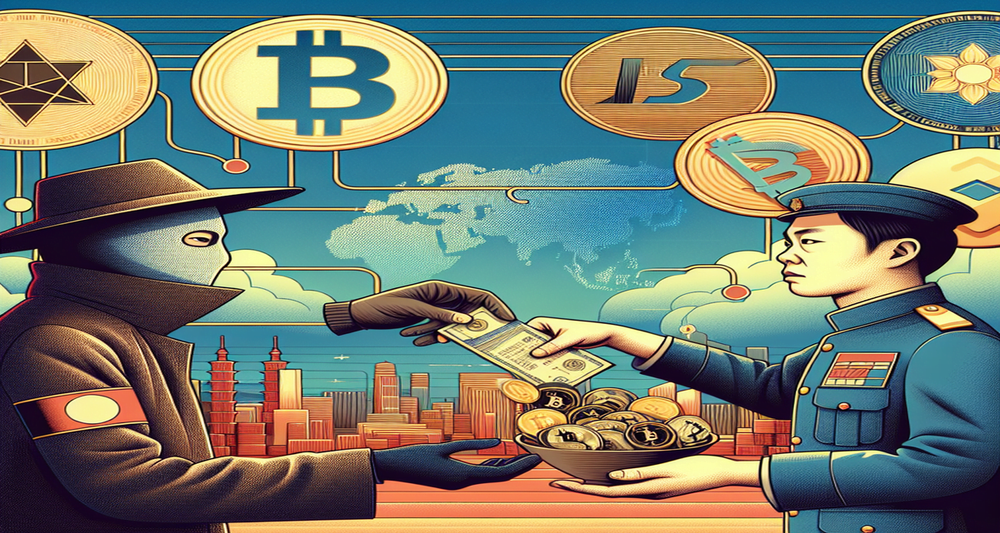

The landscape of cryptocurrency exchanges in Asia is rapidly evolving, and Taiwan finds itself at the heart of a burgeoning trend. A significant portion of this shift is driven by the use of Tether, a widely-used stablecoin pegged to the US dollar. However, with this development comes an unsettling undercurrent of treason and controversy. In this article, we explore how Tether is fueling Taiwan’s crypto exchange resurgence and the complications that arise from this financial phenomenon.

The Impact of Tether on Taiwan’s Crypto Market

Tether, known for its stable value, has become an essential tool for many crypto traders around the world. In Taiwan, its use has reached new heights, facilitating seamless transactions and reducing volatility risks. The popularity of Tether in the region has catalyzed a surge in new and revitalized crypto exchanges. This trend can be attributed to several key factors:

- Liquidity and Stability: Tether’s stability provides a reliable medium for trading, attracting investors who seek to avoid the price swings commonly associated with other cryptocurrencies.

- Regulatory Evasion: Utilizing Tether allows exchanges to circumvent some stringent regulatory measures that might apply to fiat currencies.

- Global Reach: Tether offers a bridge between digital assets and traditional currencies, making it accessible to a global audience.

Tether and the Treason Controversy

While Tether’s advantages are clear, its association with allegations of treason in Taiwan presents a darker side to its usage. Accusations have emerged suggesting that certain individuals and entities are using Tether for illicit activities, including funding operations that undermine national security. This has sparked fears and debates over the ethical implications of unregulated digital assets.

Case Studies of Unethical Usage

Recent investigations have uncovered multiple cases where Tether was allegedly used in treasonous activities:

- Funds channeled through Tether to support entities engaged in espionage.

- Money laundering by criminal organizations, leveraging the anonymity provided by Tether transactions.

- Evasion of capital controls and sanctions, allowing for the unrestricted transfer of funds across borders.

These revelations put the spotlight on potential loopholes in the regulation and monitoring of digital currencies, prompting calls for tighter oversight and enhanced security measures.

The Crypto Exchange Resurgence in Asia

Despite the controversies, the overall crypto exchange ecosystem in Asia has seen a remarkable surge. Countries like Taiwan, South Korea, and Singapore are witnessing renewed interest from both established players and newcomers in the crypto market. This resurgence is characterized by:

- Increased Investment: A surge in investments from venture capitalists and institutional investors is fueling the growth of new platforms and innovations.

- Regulatory Developments: Governments are progressively establishing regulatory frameworks to foster a secure and transparent trading environment.

- Technological Advancements: Enhanced blockchain technologies and integration with artificial intelligence are revolutionizing the trading experience.

Leading Exchanges in the Region

Several crypto exchanges stand out in Asia due to their significant influence and user base:

- Binance: Initially founded in China, Binance has become one of the world’s largest crypto exchanges, impacting markets across Asia.

- Huobi: Headquartered in Singapore, Huobi is another major player offering a diverse range of trading options and products.

- Bitfinex: With strong ties to Tether, Bitfinex has established itself as a prominent exchange favored by many traders in the region.

Future Prospects and Challenges

The future of crypto exchanges in Asia appears promising but is not without challenges. While the advantages of using stablecoins like Tether are evident, mitigating risks associated with their misuse remains critical. The path forward involves:

- Stricter Regulations: Establishing more rigorous regulatory measures to monitor financial transactions and curb illicit activities.

- Enhanced Security: Investing in advanced cybersecurity protocols to safeguard exchanges from hacks and fraud.

- Education and Awareness: Raising awareness among users about the potential risks and responsible practices in cryptocurrency trading.

While Tether continues to play a pivotal role in Taiwan’s crypto exchange resurgence, navigating the accompanying controversies and security concerns is essential for sustainable growth. As the crypto landscape evolves, collaborative efforts between governments, financial institutions, and the crypto community will be crucial in shaping a balanced and secure ecosystem.

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute professional advice. All content is based on information from sources believed to be accurate at the time of writing. However, the information may be outdated or subject to change. Always seek the advice of a qualified professional regarding any financial, legal, or health-related decisions. The author and publisher of this article are not responsible for any errors, omissions, or results obtained from the use of this information. Reliance on any information provided in this article is solely at your own risk.

By

By

By

By

By

By

By

By