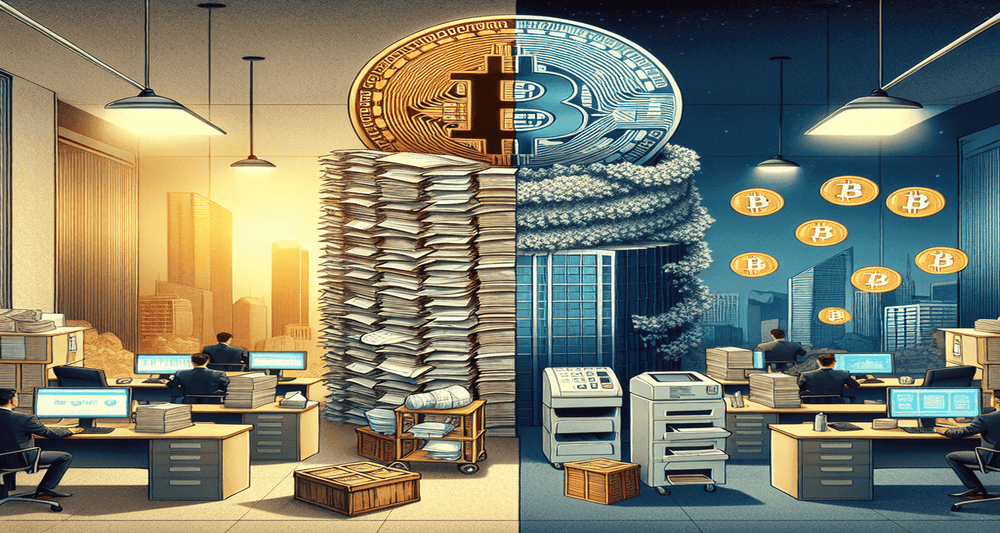

As innovative financial products continue to emerge in the cryptocurrency ecosystem, Bitcoin-collateralized loans are capturing significant attention. These loan products not only provide an alternative source of financing but also promise to accelerate the velocity of money. The CEO of Ledn, a notable financial services provider, recently highlighted how Bitcoin-collateralized loans could revolutionize both mainstream and decentralized finance.

How Bitcoin Collateral Loans Work

Bitcoin-collateralized loans operate on a simple principle: individuals or entities can use their Bitcoin holdings as collateral to secure a loan in fiat currency or stablecoins. This method provides several advantages, making them increasingly popular:

- High Liquidity

- Lower Interest Rates

- Quick Access to Funds

- Preservation of Bitcoin Holdings

Advantages of Bitcoin-Collateralized Loans

High Liquidity

Bitcoin is renowned for its high liquidity, making it an attractive asset for collateral. Traditional loans often involve lengthy approval processes, whereas Bitcoin-collateralized loans can be disbursed in mere minutes once the collateral is verified.

Lower Interest Rates

Another significant advantage is the lower interest rates associated with these loans. Because the loan is backed by a highly liquid asset, lenders face less risk. This reduced risk translates into lower interest rates for borrowers.

Quick Access to Funds

The speed at which funds can be accessed is another critical factor. Borrowers can receive funds almost instantly after pledging their Bitcoin as collateral, providing a rapid solution for those in need of immediate cash flow.

Preservation of Bitcoin Holdings

By taking out a Bitcoin-collateralized loan, investors can unlock liquidity without needing to sell their Bitcoin holdings. This feature is crucial, especially during times when individuals believe the value of Bitcoin will appreciate in the future.

The Role of Bitcoin-Collateralized Loans in Accelerating the Velocity of Money

The CEO of Ledn argued that Bitcoin-collateralized loans contribute to a faster velocity of money in the economy. The velocity of money measures the rate at which money changes hands within an economy. A higher velocity is often associated with a more dynamic and prosperous financial environment.

Here’s how Bitcoin-collateralized loans help to increase the velocity of money:

- **Increased Spending Power**: Borrowers can use the loaned funds for various expenditures, stimulating economic activities.

- **Investment Opportunities**: The capital unlocked from these loans can be reinvested into ventures, stocks, or other financial assets, creating a cycle of investment and innovation.

- **Market Liquidity**: By freeing up Bitcoin assets, market liquidity improves, allowing for smoother trading and financial operations.

Ledn’s Insight on the Future of Bitcoin-Collateralized Loans

The CEO of Ledn is optimistic about the future of Bitcoin-collateralized loans. As more people recognize their benefits, it’s likely that these financial products will become mainstream. The notion of using a highly liquid, appreciating asset as collateral opens up new avenues for personal and organizational financing.

Challenges and Considerations

While the advantages are numerous, it’s essential to consider the challenges and risks associated with Bitcoin-collateralized loans. Market volatility remains a critical concern. If Bitcoin’s price drops significantly, borrowers may face margin calls requiring them to increase their collateral or repay the loan.

Furthermore, the regulatory landscape remains uncertain. As governments and financial authorities around the world grapple with how to regulate cryptocurrencies, borrowers and lenders alike must stay informed about potential legal implications.

Despite these challenges, the growing interest and adoption of Bitcoin-collateralized loans signify a paradigm shift in modern finance. They offer a tangible example of how blockchain technology and digital assets can integrate with traditional financial systems to create innovative products.

For more details, you can read the original article ->Here.

Disclaimer: The information provided in this article is for general informational purposes only and does not constitute professional advice. All content is based on information from sources believed to be accurate at the time of writing. However, the information may be outdated or subject to change. Always seek the advice of a qualified professional regarding any financial, legal, or health-related decisions. The author and publisher of this article are not responsible for any errors, omissions, or results obtained from the use of this information. Reliance on any information provided in this article is solely at your own risk.

By

By

By

By

By

By

By

By